vt dept of taxes forms

Article 20 of the US-China income tax treaty allows an exemption from tax for scholarship income received by a Chinese student temporarily present in the United States. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms.

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Ad Free For Simple Tax Returns Only.

. Vermont Unemployment Insurance Tax. The 1099-G is a tax form for certain government payments. Use a vt form sut 451 template to make your document workflow more streamlined.

Monday January 24 2022 - 1200. The Department has worked to ensure information was correct to the best of its ability. Business Start-Up Guide Step-by-step guide and resources for starting a new business in Vermont.

Box 488 Montpelier 05601-0488 802 828-4000. For more information on 1099-G tax forms visit the Departments website for frequently asked questions information on programs and benefit codes how unemployment insurance benefits are calculated more. We last updated Vermont Form IN-111 in February 2022 from the Vermont Department of Taxes.

IN-111-2021pdf 8391 KB File Format. Most states will release updated tax forms between January and April. Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment insurance benefits during the prior calendar year.

The vermont income tax rate for tax year 2020 is progressive from a low of 335 to a high of 875. Law this student will. For details on late filing see the instructions.

Save and go to Important Printing Instructions Phone 802 828-2551 VT Form SUT-451 PO Box 547 Montpelier VT 05601-0547 154511100 Tax returns must be filed even if no tax is due. From Simple to Advanced Income Taxes. Taxes for Individuals File and pay taxes online and find required forms.

2022 Form IN-114 Individual Income Estimated Tax Payment Voucher. 0 Fed 1499 State. Form HS-122 HI-144 Vermont Department of Taxes 221221100 2022 Form HS-122 Vermont Homestead Declaration AND Property Tax Credit Claim 2 2 1 2 2 1 1 0 0 DUE DATE.

Elections voting absentee ballot request formdoc absentee ballot request formpdf. TurboTax Is Designed To Help You Get Your Taxes Done. 10231X Form W-9 Rev.

The first installment is due by august 13 2021 and the second installment is due by november 5 2021. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Form IN-114 - Estimated Income Tax.

If you were paid unemployment insurance benefits in 2020 you will receive a 1099G form for your tax filing. Get Your Maximum Refund When You E-File With TurboTax. You may file up to Oct.

Vermont has a progressive income tax rate ranging from 335 to 875 with varying tax brackets. Tax Year 2021 Form IN-111 Vermont Income Tax Return. Mon 01242022 - 1200.

Dept of state vt dept. However if information on-file was provided incorrectly or if claimants have moved or changed their names 2021 Unemployment Insurance Claimants may request corrections to their 1099-G tax form additional copies of their new 1099-G or report receiving a 1099-G due to suspected fraud. Of motor vehicles vt dept.

Monday February 14 2022 - 1200. 8-2013 Vermont Dept of Forests Parks Rec. Form IN-114 is a Vermont Individual Income Tax form.

Quickly Prepare and File Your 2021 Tax Return. Business Tax Center Find guidance on paying taxes as a. Box 488 Montpelier 05601-0488 802 828-4000.

The Department will mail your 1099G no later than January 31 2021 as required by law. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis. This form is for income earned in tax year 2021 with tax returns due in April 2022.

IN-114-2021pdf 6192 KB File Format. Vermont Department of Taxes Sales and Use Tax Return For faster processing. Vermont employers pay a varying unemployment tax rate of 04 to 54 on a taxable wage base of 14100Depending on the industry new employers pay a tax rate ranging.

Understand and comply with their state tax obligations. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Vermont Department of Labor 5 Green Mountain Drive PO.

Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. Vermont Department of Labor 5 Green Mountain Drive PO. Tax Year 2021 Form WH-435 Estimated Income Tax Payments for Nonresident Shareholders Partners or Members.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. Use myVTax the departments online portal. 17 2022 but the town may assess a penalty.

Vermont has a state income tax that ranges between 3350 and 8750. Estimated Income Tax Individuals Personal Income Tax. TaxFormFinder provides printable PDF copies of 52 current Vermont income tax forms.

Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. One National Life Drive Davis 2 Montpelier VT 05620-3801. Other Vermont Individual Income Tax Forms.

If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. The current tax year is 2021 with tax returns due in April 2022. Vermont has the following payroll taxes.

Estimated tax payments must be sent to the Vermont Department of Taxes on a quarterly basis.

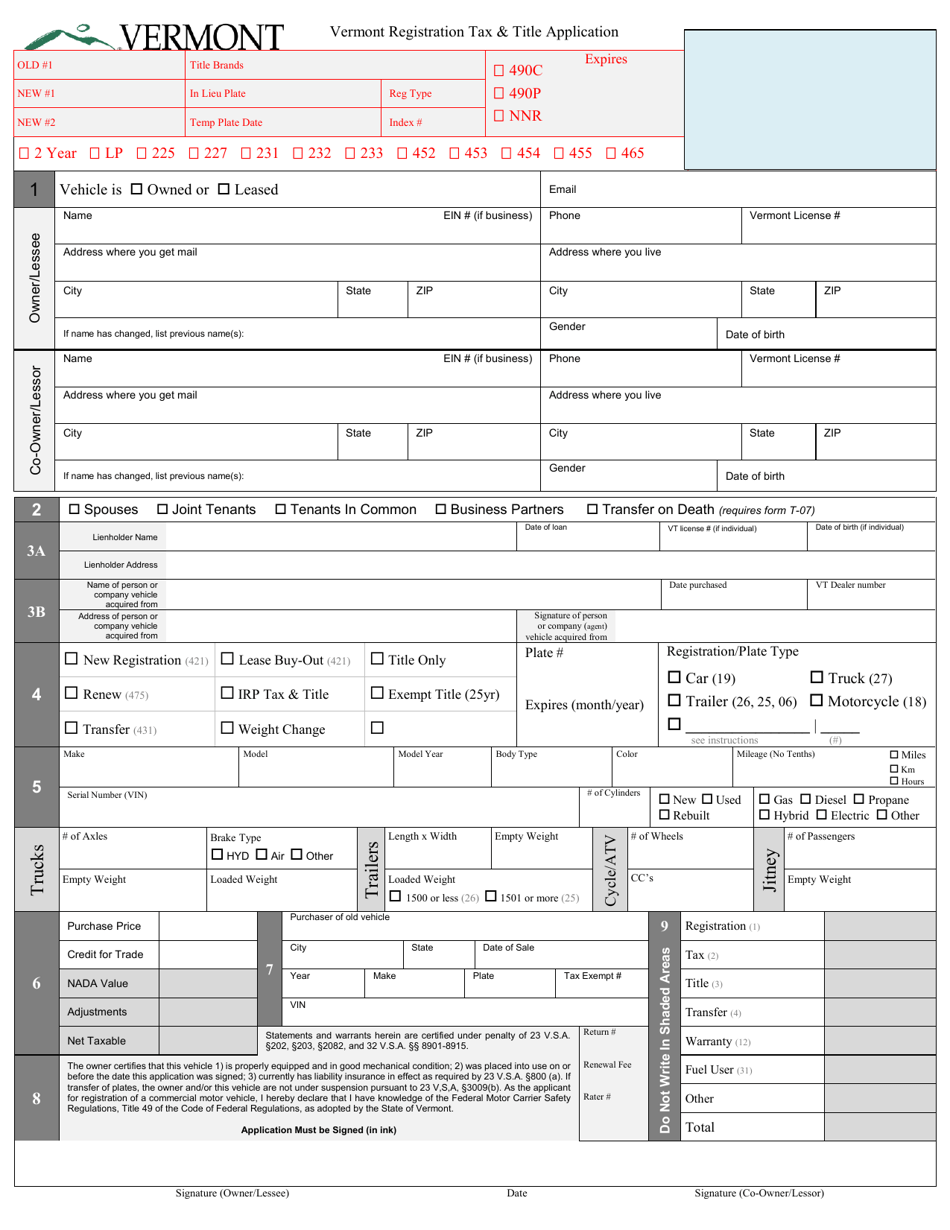

Snowmobile Registration Amp Title Application Vermont Department

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Form Vd 119 Download Fillable Pdf Or Fill Online Vermont Registration Tax Title Application Vermont Templateroller

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Publications Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

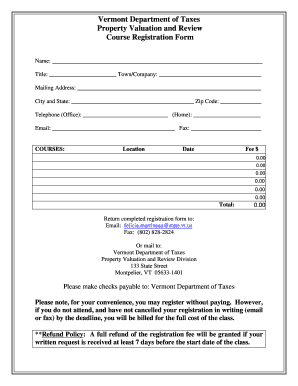

Home Valuation Form Fill Online Printable Fillable Blank Pdffiller

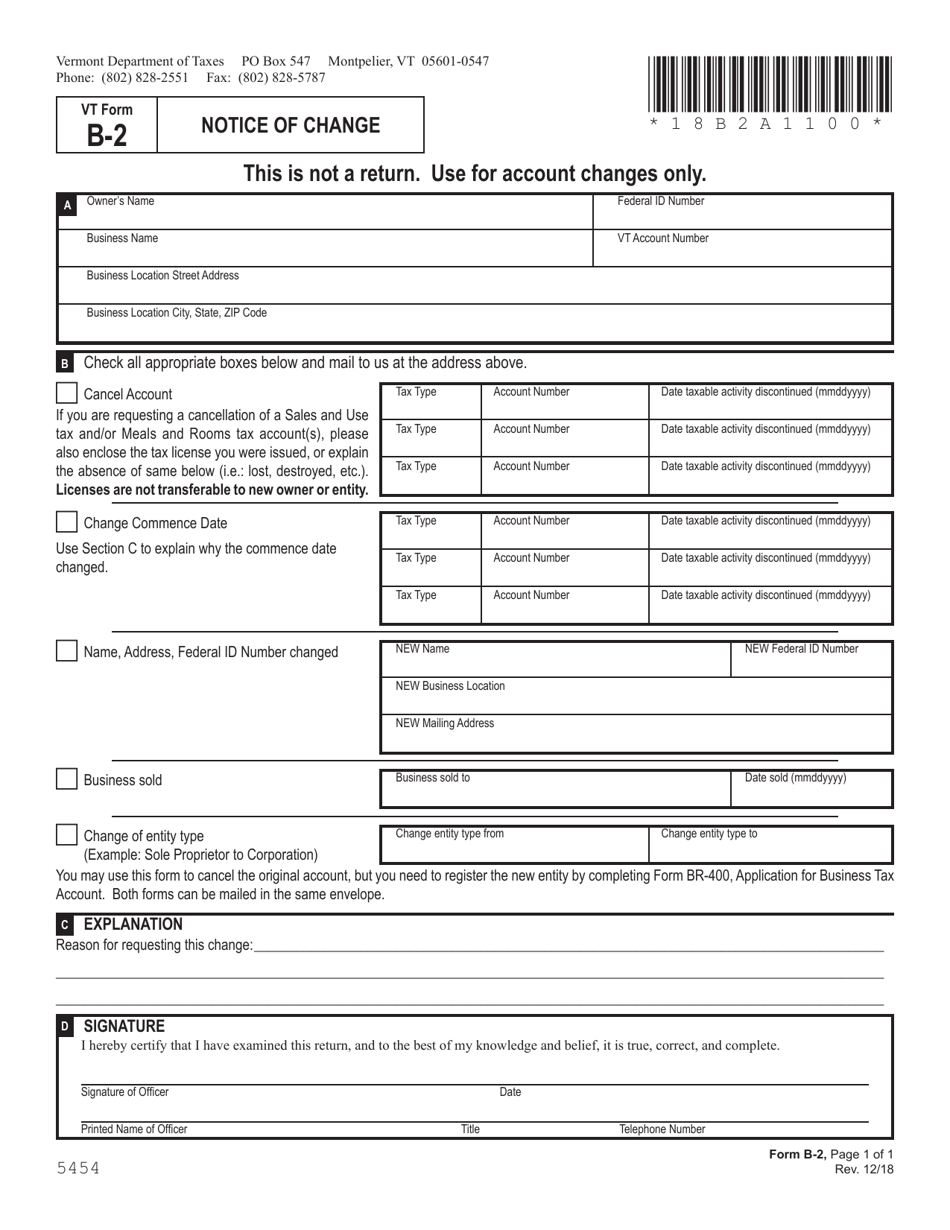

Vt Form B 2 Download Printable Pdf Or Fill Online Notice Of Change 2018 Templateroller

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Vt Dept Of Taxes Vtdepttaxes Twitter